what is maryland earned income credit

The Earned Income Tax Credit also called the EITC is a benefit for working people with low-to-moderate income. Some taxpayers may even qualify for a refundable Maryland EITC.

Good News Child Tax Credit Available This Year When Filing Taxes Montgomery County Public Schools

See instruction 26 in the Maryland Tax Booklet for more information on claiming the Earned Income Credit.

. The local EITC reduces the amount of county tax you owe. The Maryland Earned Income Tax Credit can provide some necessary breathing room as at least one burden can be legitimately reduced The CASH Campaign of Maryland and its partners are part of an IRS program to help prepare and electronically file qualifying Marylanders federal and state tax returns for free. If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund.

If you either established or abandoned Maryland residency during the calendar year you are considered a part-year resident. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. Colorado lawmakers in December passed a 300.

That group of taxpayers which. Senate Bill 218 extends the tax credit to people who pay taxes using Individual Taxpayer Identification Numbers ITINs for the 2020 2021 and 2022 tax years. The Maryland earned income tax credit EITC will either reduce or eliminate.

The Maryland earned income tax credit EITC will either reduce or eliminate. Workers who qualify for the EIC and file a federal tax return can get back some or all of the federal income tax that was taken out of their pay during the year. Maryland Refundable EIC is worth 40 million more this tax season.

If you are neither a Full-Year Resident nor a Part-Year Resident you are not a resident. This is available for the 2021 tax year dependent on your adjusted gross income AGI. 50 of federal EITC 1.

It can reduce your federal taxes possibly to zero. Some taxpayers may even qualify for a refundable Maryland EITC. Find out what to do.

Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. The local EITC reduces the amount of county tax you owe. 28 of federal EITC.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. The Maryland earned income tax credit. R allowed the bill to take effect without his signature.

The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income. Find out what to do. The EIC is designed primarily to benefit families.

Earned Income Tax Credit EITC Rates. In May 2018 Maryland passed legislation to eliminate the minimum age requirement for the state-level EITC. The Earned Income Tax Credit EIC is a federal tax benefit for low-income and moderate-income individuals who work full-time part-time or part of the year.

You may claim the EITC if your income is low- to moderate. Income limits vary depending on your filing status AGI and the number of dependents. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income.

An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov. You may qualify for extra cash back from the IRS - a refund of more. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit.

In some cases the EIC can be greater than your total income tax bill providing an income tax refund to families that may have little or no income tax withheld from. What is the Earned Income Credit. Earned Income Tax Credit EITC.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. 2019 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. Thestate EITCreducesthe amount of Maryland tax you owe.

If you qualify for this credit it may offer significant tax savings. Maryland is the only state to include an expansion of the EITC as part of a stimulus plan according to the National Conference of State Legislatures. It is different from a tax deduction which reduces the amount of income that your tax is calculated on.

Thelocal EITC reduces the amount of county tax you owe. HOME Resources Find Free Tax Assistance In Maryland Earned Income Tax Credit EITC is a tax benefit for low-and moderate-income workers worth up to 5751 for families. See Marylands EITC information page.

2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. If you claimed an earned income credit on your federal return or would otherwise have been eligible to claim an earned income credit on your federal return but for you or your spouse filing with an individual taxpayer identification number ITIN and if you have at least one qualifying child then you may claim one-half 50 of the federal credit on your Maryland. Credit is actually money back on your tax bill.

Expanded to include childless houesholds Governor OMalley and the General Assembly expanded the Maryland refundable earned income credit REIC during the Special Session in November 2007 increasing the REIC from 20 to 25 of the federal EIC and extending the REIC to taxpayers without qualifying. The program is administered by the Internal Revenue Service IRS and is a major anti-poverty initiative. It is used to offset the amount you owe on taxes and if income tax has already been withheld the EITC can.

The Maryland earned income tax credit. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. The state EITC reduces the amount of Maryland tax you owe.

IRS-certified staff check for tax credits like. Did you receive a letter from the IRS about the EITC. Some taxpayers may even qualify for a refundable Maryland EITC.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. The state EITC reduces the amount of Maryland tax you owe. It is a special program for low and moderate-income persons who have been employed in the last tax year.

As you prepare to file your 2021 tax return keep these 4 tax savings tips in mind. They may also get. Log Out If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit.

Psy 326 Psy326 Quiz 2 Answers 2020 Ashford Quiz Online Study Psychology

What Is The Earned Income Tax Credit And Do You Qualify For It Youtube

Child Tax Credit Schedule 8812 H R Block

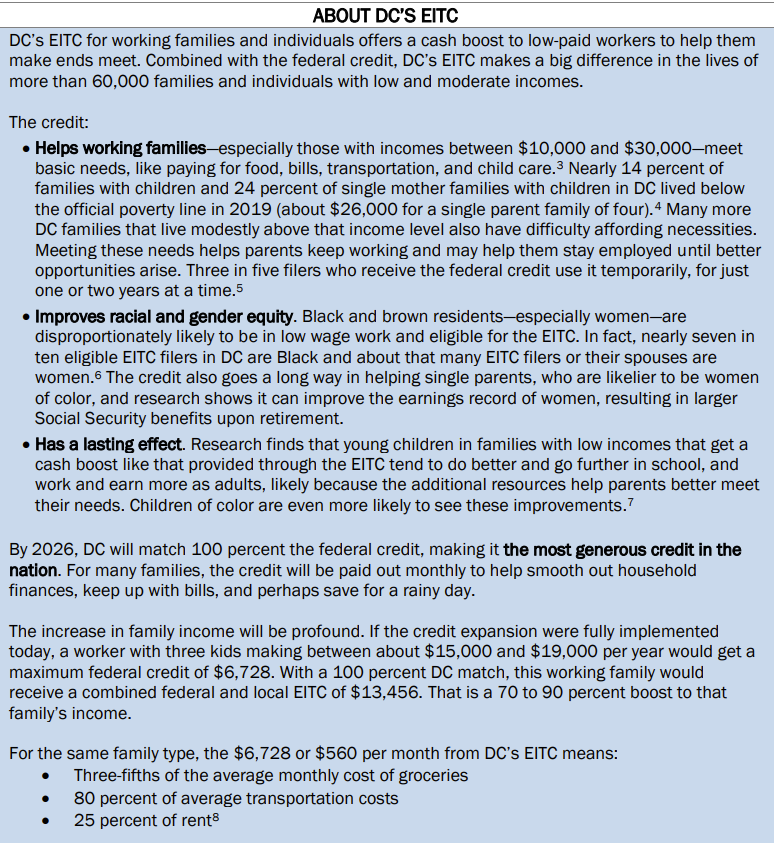

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

Money Make Money Love Money Cash Cash Money Euro Dollar Euros Dollars Money Cash Cashback Money Cash Money Stacks Rich Money

How Do State Earned Income Tax Credits Work Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

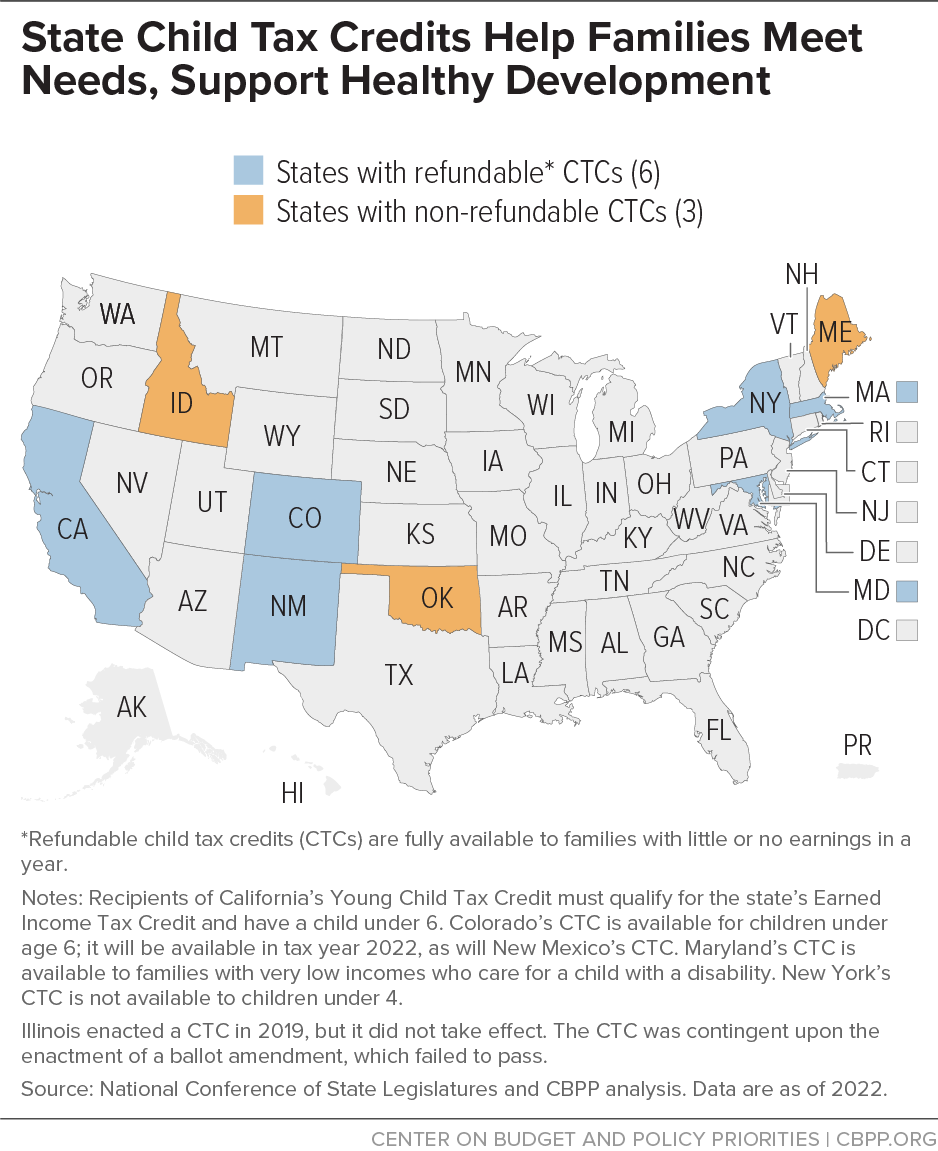

States Should Create And Expand Child Tax Credits Center On Budget And Policy Priorities

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

.png)

What Is The Earned Income Credit Check City

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Polozhenie O Deloproizvodstve Cifrovye Snt Deloproizvodstvo

Earned Income Tax Credit Now Available To Seniors Without Dependents

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

What Is The Earned Income Credit Check City

Acceptable Income And Job History For A Mortgage Loan Approval In Kentucky Buying First Home Real Estate Tips Real Estate Infographic